Portfolio update - 2018 May

The half cliche half myth of 'Sell in May and go away' turned out quite true for STI, but less so for my portfolio. STI dropped from 3613.93 to 3428.18, erasing 5.14% gain before factoring in dividend gain. From stocks cafe, STI index dropped 4% from 7% to 2.97% TWR; while my portfolio dropped 1.89% from -1.27% to -3.16% TWR. What an irony when it is finally outperforming STI for the month, it is actually sinking deeper in red.

Despite market sinking lower and lower each day, I have not engaged in the battlefield like my previous month and enjoyed a calm period where I could spent time following up on my existing stocks and studying fundamentals of potential ones. I have sold all Valuetronics in early month @ $0.785 for kopi money, and used it to trade Venture for kopi powder money. The rest of my core holdings are intact, and I have only added YZJ towards the end of the month @ $0.955.

Below are my quick views of related stocks:

Valuetronics: In previous month I have used noob analysis to come out with TP $0.81 if Q4 revenue hits 700 mil HKD (400m for ICE and 300m for CE), and TP $0.87 if Q4 revenue hits 740 mil HKD. With price advanced closer to my conservative TP, I sold it off for meagre gain to reduce my exposure to tech. When the Q4 was released end of the month, the revenue was unfortunately even lower than my conservative estimate.

It's known that CE business would be affected by slower demands for smart LED (which caused the panic sharp price drop), but not ICE business that is supposed to grow. Quarter Y-o-Y for ICE is actually flat, which may be a hidden concern. Though analysts have reduced TPs for Valuetronics, they still maintained a rosy outlook.

- RHB: TP reduced from $0.96 to $0.92

- CIMB: TP reduced from $1.10 to $0.95

- MKE: TP reduced from $1.25 to $1.15

- UOBKH: TP increased from $0.96 from $0.95

For me I would consider buy the first tranche if price falls to 0.7.

AEM: Nothing much happens except for the bonus share ex-date. A new independent director Loh Kin Wah, who is is an industry veteran especially in the memory field has been appointed and bought 50k shares pre-bonus for 280k, which translates to avg price of $1.404 now.

Alliance mineral: Exciting month for AMAL as first shipment of lithium concentrate has been shipped to Burwill and caused Burwill's share price rose from $0.355 to $0.4; while both its price and Tawana's price remained muted. The EV business is really picking up with rocketing sales and huge $ injected into it like the massive Volkswagen's 40b Euros' deal to battery producers.

Two institutions: Regal Funds Management (34 mil shares, or 5.41% for $0.33 per share) and LIM Asia Special Sitautions Master Fund Limited (30mil shares, or 4.7% to increase its stake to 9.5% for $0.35 per share) emerged as substantial shareholders. What show is ex-CEO and his wife playing by selling their portion is anyone's guess. And how on earth we could now buy AMAL's shares at price cheaper than management share's reward price is even more puzzling. If the price has to dropped, then let it plunges to $0.3 ok?

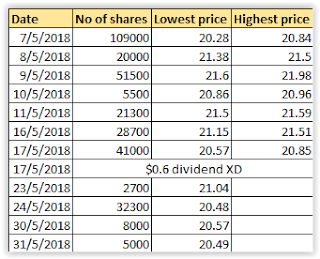

Venture: The company became addicted to share buy backs and bought back its own shares in 11 trading days, totaled 325k shares in the range of $20 to $22. If we assume avg purchase price for all these shares is $21, the company have spent 6.82 mil (4.7% of FY2017 profit) in shares buy back this month. Is it a strong confidence in fundamentals or merely defensive action against price drop? I believe the veteran CEO is not interested in doing wayang work.

Yanlord: Reported a good 1Q18 results with 22% increase in profit but -15% decrease in profit for owners of the company. The company is confident about its performance this year and it is evidenced by CEO's further buying of 3.9mil shares at average price of $1.7 to increase his stakes of the company to 69.8%. Interestingly, DBS has speculated that its recent change in company's org chart by recruiting senior personnel from large developers like Vanke and Longfor will improve its asset turnover and result in stock re-rating.

Geo Energy: Reported a lacklustre 1Q18 result due to 40% higher rainfall Y-o-Y caused a 10% drop in coal production, despite having an increase of 7% in ASP. Finance cost is of course burning, but the first coal production in TBR mine is expected this month, and hopefully a good offtake for TBR could be finalized soon.

GSS Energy: Reported a good 1Q18 result with 12% increase in revenue and gross profit. Profit dropped 42% due to increasing expenses for O&G business which have yet to generate revenue.

For other holdings, nothing much happens except that Sunningdale's price rebounced on UOBKH's buy call, and Federal Intl keeps dropping on low volume green bar, which makes me suspects that the price is controlled for reason not revealed. My only REIT, Manulife calls for another round of rights offering to buy another two assets, without really increasing the DPU. If they keeps on doing this without being DPU accretive, soon the market will grow weary on it.

So all in all, a quite month for me for my existing holdings. Except for YZJ, who suffered another round of sell down after HSBC's biased sell call. I have learnt my mistake last month, and have only bought it after analyzing it. Its really an interesting sell call. Too busy to write about my analysis on YZJ, hopefully I could get some time next week.

Despite market sinking lower and lower each day, I have not engaged in the battlefield like my previous month and enjoyed a calm period where I could spent time following up on my existing stocks and studying fundamentals of potential ones. I have sold all Valuetronics in early month @ $0.785 for kopi money, and used it to trade Venture for kopi powder money. The rest of my core holdings are intact, and I have only added YZJ towards the end of the month @ $0.955.

Below are my quick views of related stocks:

Valuetronics: In previous month I have used noob analysis to come out with TP $0.81 if Q4 revenue hits 700 mil HKD (400m for ICE and 300m for CE), and TP $0.87 if Q4 revenue hits 740 mil HKD. With price advanced closer to my conservative TP, I sold it off for meagre gain to reduce my exposure to tech. When the Q4 was released end of the month, the revenue was unfortunately even lower than my conservative estimate.

It's known that CE business would be affected by slower demands for smart LED (which caused the panic sharp price drop), but not ICE business that is supposed to grow. Quarter Y-o-Y for ICE is actually flat, which may be a hidden concern. Though analysts have reduced TPs for Valuetronics, they still maintained a rosy outlook.

- RHB: TP reduced from $0.96 to $0.92

- CIMB: TP reduced from $1.10 to $0.95

- MKE: TP reduced from $1.25 to $1.15

- UOBKH: TP increased from $0.96 from $0.95

For me I would consider buy the first tranche if price falls to 0.7.

AEM: Nothing much happens except for the bonus share ex-date. A new independent director Loh Kin Wah, who is is an industry veteran especially in the memory field has been appointed and bought 50k shares pre-bonus for 280k, which translates to avg price of $1.404 now.

Alliance mineral: Exciting month for AMAL as first shipment of lithium concentrate has been shipped to Burwill and caused Burwill's share price rose from $0.355 to $0.4; while both its price and Tawana's price remained muted. The EV business is really picking up with rocketing sales and huge $ injected into it like the massive Volkswagen's 40b Euros' deal to battery producers.

Two institutions: Regal Funds Management (34 mil shares, or 5.41% for $0.33 per share) and LIM Asia Special Sitautions Master Fund Limited (30mil shares, or 4.7% to increase its stake to 9.5% for $0.35 per share) emerged as substantial shareholders. What show is ex-CEO and his wife playing by selling their portion is anyone's guess. And how on earth we could now buy AMAL's shares at price cheaper than management share's reward price is even more puzzling. If the price has to dropped, then let it plunges to $0.3 ok?

Venture: The company became addicted to share buy backs and bought back its own shares in 11 trading days, totaled 325k shares in the range of $20 to $22. If we assume avg purchase price for all these shares is $21, the company have spent 6.82 mil (4.7% of FY2017 profit) in shares buy back this month. Is it a strong confidence in fundamentals or merely defensive action against price drop? I believe the veteran CEO is not interested in doing wayang work.

Yanlord: Reported a good 1Q18 results with 22% increase in profit but -15% decrease in profit for owners of the company. The company is confident about its performance this year and it is evidenced by CEO's further buying of 3.9mil shares at average price of $1.7 to increase his stakes of the company to 69.8%. Interestingly, DBS has speculated that its recent change in company's org chart by recruiting senior personnel from large developers like Vanke and Longfor will improve its asset turnover and result in stock re-rating.

Geo Energy: Reported a lacklustre 1Q18 result due to 40% higher rainfall Y-o-Y caused a 10% drop in coal production, despite having an increase of 7% in ASP. Finance cost is of course burning, but the first coal production in TBR mine is expected this month, and hopefully a good offtake for TBR could be finalized soon.

GSS Energy: Reported a good 1Q18 result with 12% increase in revenue and gross profit. Profit dropped 42% due to increasing expenses for O&G business which have yet to generate revenue.

For other holdings, nothing much happens except that Sunningdale's price rebounced on UOBKH's buy call, and Federal Intl keeps dropping on low volume green bar, which makes me suspects that the price is controlled for reason not revealed. My only REIT, Manulife calls for another round of rights offering to buy another two assets, without really increasing the DPU. If they keeps on doing this without being DPU accretive, soon the market will grow weary on it.

So all in all, a quite month for me for my existing holdings. Except for YZJ, who suffered another round of sell down after HSBC's biased sell call. I have learnt my mistake last month, and have only bought it after analyzing it. Its really an interesting sell call. Too busy to write about my analysis on YZJ, hopefully I could get some time next week.

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.